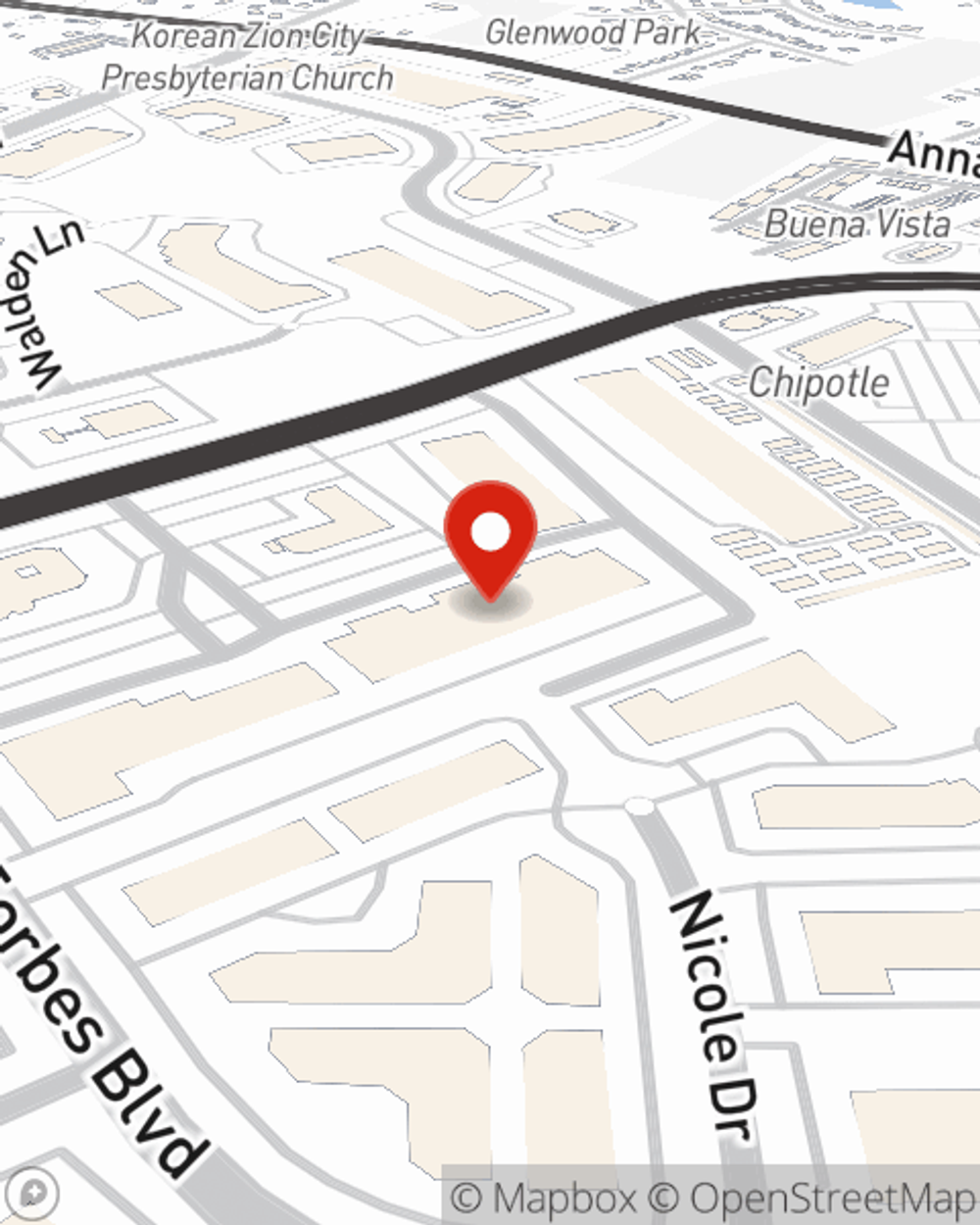

Business Insurance in and around Lanham

One of Lanham’s top choices for small business insurance.

Helping insure small businesses since 1935

Insure The Business You've Built.

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent James Allen, a fellow business owner, is not unaware of the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

One of Lanham’s top choices for small business insurance.

Helping insure small businesses since 1935

Get Down To Business With State Farm

For your small business, whether it's an auto parts shop, an art gallery, an advertising agency, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, equipment breakdown, and loss of income.

At State Farm agent James Allen's office, it's our business to help insure yours. Contact our wonderful team to get started today!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

James Allen

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.